SIMPLIFY TRADING

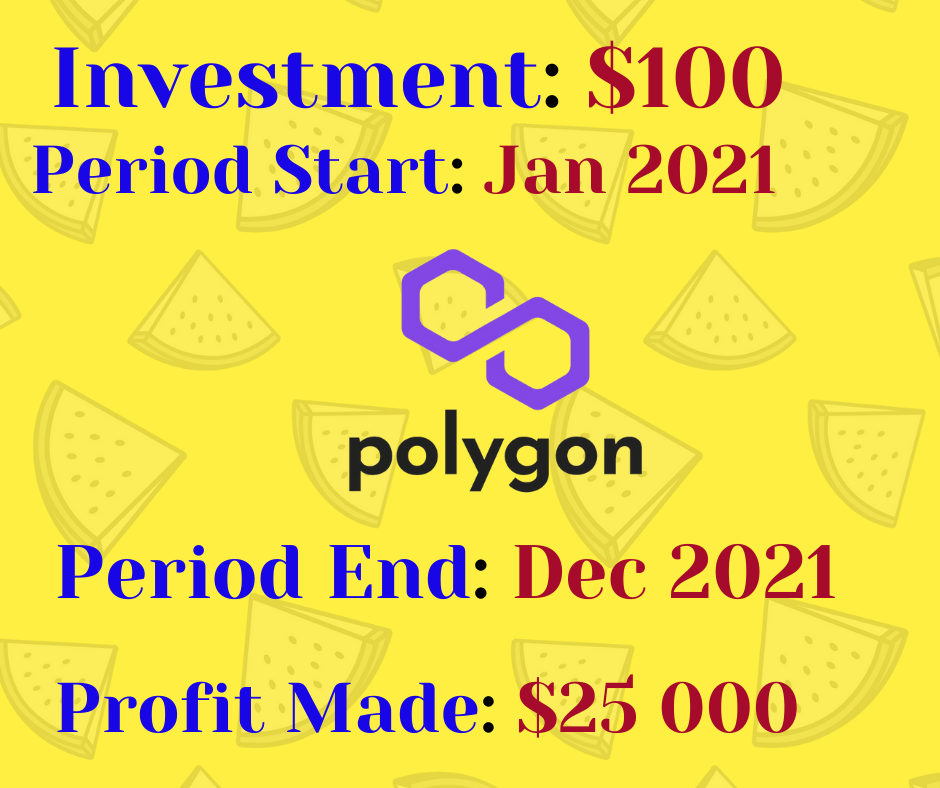

Connect Your Trading Exchange to our Profitable Strategies to Automatically Execute trades. Our Trading Floor has Yielded High Results Over a Period of time without Fail.

Connect Your Trading Exchange to our Profitable Strategies to Automatically Execute trades. Our Trading Floor has Yielded High Results Over a Period of time without Fail.

Newbies and Inexperienced Traders don’t have to worry about Managing Accounts or Analysing the Markets as our Automated Engines Do the Trading.

Each token rebalances daily to ensure constant leverage ratios of the underlying assets are always maintained.

Traders don't have to worrry about managing funding rates, borrowing costs or monitoring positions for risks of margin calls.

Empire Crypto Trading Lab is the Biggest Trading Community.

Copyright 2022 Empire Crypto. All rights reserved.